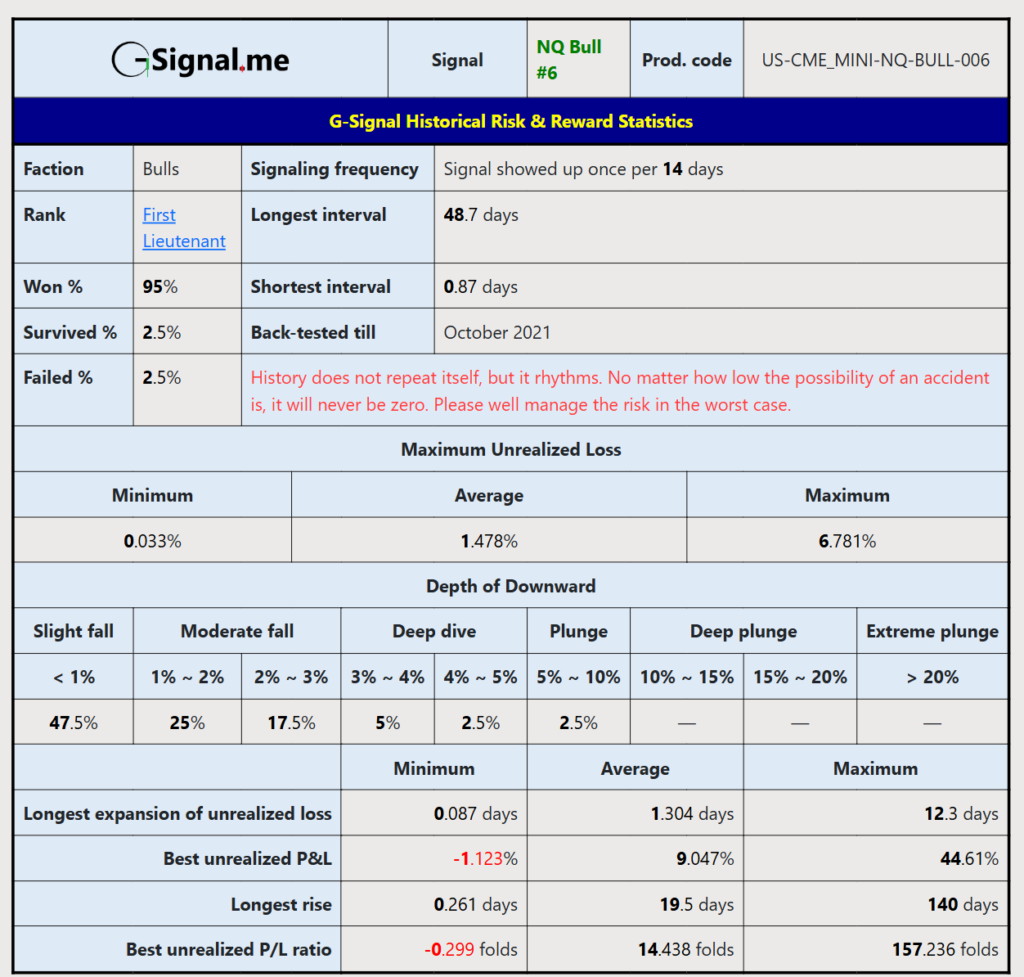

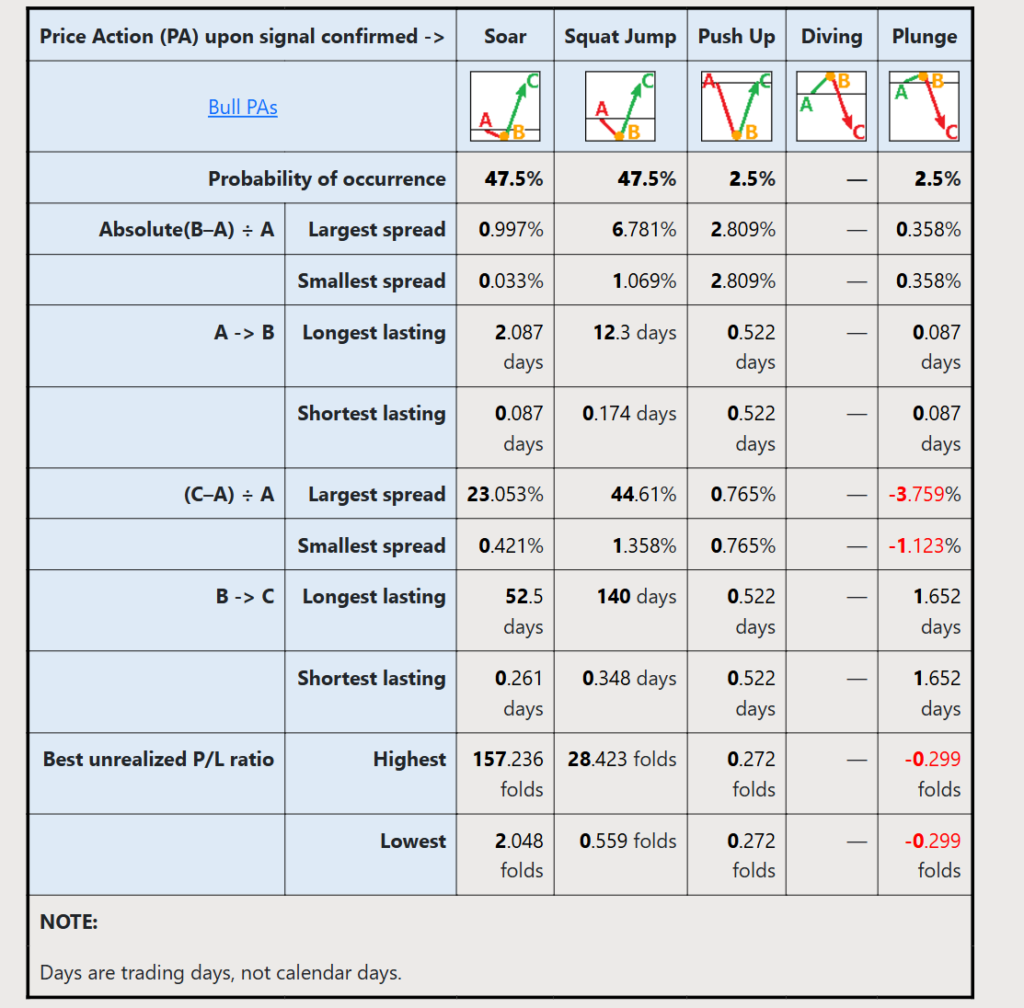

Top 5 Historical Risk and Reward Statistics from Our AI Trading Platform

Historical risk and reward statistics play a vital role in evaluating the performance of any AI trading platform. At G-Signal.Me, we believe in full transparency — which is why we provide detailed data-driven insights into our trading system’s past performance, win/loss ratios, and reward-to-risk metrics across key markets like NASDAQ and S&P 500.

Why Historical Risk and Reward Data Matters

Trading isn’t just about taking action; it’s about understanding the probability behind every decision. By reviewing historical risk and reward statistics, traders can gain a clearer picture of what to expect — including:

-

Win-to-loss ratio

-

Risk boundaries

-

Drawdowns

-

Average returns over time

This data-driven approach helps remove guesswork and emotions, leading to more confident decisions.

Our AI-Powered System and Historical Data

G-Signal.Me’s proprietary AI engine uses NI-OML (Natural Intelligence – Organic Machine Learning) to analyze huge sets of historical data. It studies historical risk and reward statistics from NASDAQ, S&P 500, and other top indices, improving the accuracy of signals every day.

This historical intelligence gives our platform an edge — instead of random alerts, we deliver signals rooted in actual past market behavior.

-

Win-to-loss ratio

-

Risk boundaries

-

Drawdowns

-

Average returns over time

This data-driven approach helps remove guesswork and emotions, leading to more confident decisions.

Benefits of Studying Historical Risk and Reward Statistics

-

Identify consistent win patterns

-

Spot high-risk trading zones

-

Understand volatility behavior

-

Compare AI predictions with past outcomes

Each of these data points contributes to a stronger, risk-managed trading approach.

This historical intelligence gives our platform an edge — instead of random alerts, we deliver signals rooted in actual past market behavior.

-

Win-to-loss ratio

-

Risk boundaries

-

Drawdowns

-

Average returns over time

This data-driven approach helps remove guesswork and emotions, leading to more confident decisions.

G-Signal’s Real Market Performance

With historical risk and reward statistics available across assets like the NASDAQ 100, our users can review how our system responded in various market conditions — from high volatility to steady growth. These stats provide both reassurance and tactical insight.

External Resource for Further Learning

Want to understand how risk and reward ratios are calculated? Visit Investopedia’s explanation for a deeper breakdown.

Conclusion

Historical risk and reward statistics aren’t just numbers — they are the roadmap for smarter, safer trades. At G-Signal.Me, we believe that historical insight is a trader’s greatest ally. That’s why our platform places this data front and center, helping you execute with clarity and precision.

At G-Signal.Me, we don’t believe in vague promises — we believe in numbers. That’s why our AI trading platform offers a detailed record of historical risk and reward statistics that reflects how our signals performed in both bullish and bearish markets. Whether you’re interested in short-term scalping or long-term trend-following, having access to solid performance data can dramatically improve your results.

Our platform gives you the tools to see the exact risk-reward ratio before you take action. This clarity helps you avoid trades based on speculation, emotions, or social media hype. Instead, every alert is backed by a rich library of past performance insights — a unique advantage of G-Signal.Me.

Understanding these historical risk and reward statistics can also guide you in setting better stop-loss levels, position sizes, and entry points. It’s not just about chasing profit — it’s about managing risk with precision and discipline.

As financial markets continue to evolve, the value of accurate and actionable data only increases. With G-Signal.Me, you are not just trading signals; you’re trading with historical intelligence.

To become a truly informed trader, it’s important to rely on data rather than assumptions. That’s why we provide comprehensive historical risk and reward statistics for all major trading signals. These statistics help you identify consistent patterns, evaluate long-term performance, and make calculated decisions based on facts. When you trade with G-Signal.Me, you’re equipped with knowledge that reduces uncertainty and increases trading confidence.

Explore More G-Signal.Me Insights

For a deeper understanding of how our system works, we recommend exploring the following pages:

-

Learn about our mission and background on the About G-Signal.Me page

- Interested in earning with us? Check out our Affiliate Program

-

If you need help or have questions, visit our Contact Us page

These resources offer a complete picture of our AI-powered approach to smart trading.